4. Smart chips: These very small steel processors make cards safer than classic magnetic-stripe-only playing cards. Chips enable it to be more challenging for robbers to make use of stolen charge card figures.

Create a spending budget, just take Charge of your paying out, and keep track of your development toward your fiscal aims with Wells Fargo's online revenue administration Software.

Don’t retail outlet unnecessary facts: Steer clear of storing cardholder name facts lengthier than needed. Apply knowledge retention policies to routinely purge unneeded data from your programs.

Educate staff members: Practice your employees on most effective methods for details security, like the importance of safeguarding cardholder name data. Inspire them to comply with protected password suggestions and become vigilant for phishing tries.

Have questions about creating your credit score score, deciding on the appropriate credit card or Studying about charge card benefits? Find out more about these subject areas plus much more.

Overdraft Protection is definitely an optional service we offer. With the company to choose impact you will have to enroll. You're only billed for Overdraft Safety when you utilize it.

Be patient all through this transition time. Details updates will take thirty-90 days throughout economic methods. Meanwhile, have paperwork like a marriage certification that link your outdated and new names.

Issue to account eligibility needs. If you end up picking to website link your account to your Wells Fargo checking account for Overdraft Defense, make sure you Observe the following. In case you have a joint checking account, you'll be chargeable for all improvements, like interest and costs, from the charge card to cover overdrafts, irrespective of who writes the Test, makes the debit card obtain, or engages in almost every other transaction that triggers the overdraft. Desire will accrue from the date Every single advance is designed.

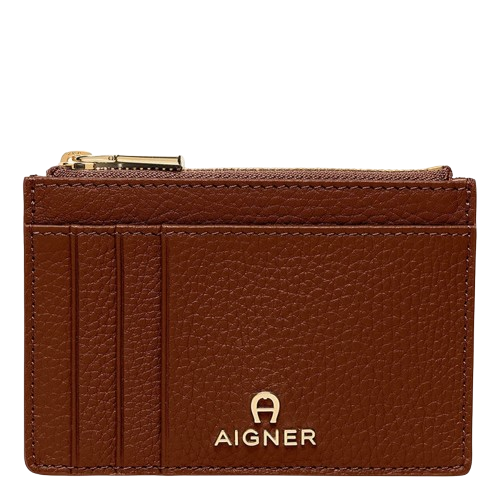

3. Cardholder’s name: This is the human being approved to work with the card. That person didn’t cardholder services essentially open the account—they might basically have permission to spend with the account as an “licensed consumer.

Dashia Milden Editor Browse far more from Dashia Dashia is usually a staff members editor for CNET Revenue who covers all angles of private finance, which includes bank cards and banking. From testimonials to information protection, she aims to aid viewers make extra informed selections with regards to their money.

one. Financial institution branding: This segment identifies your card issuer. Cards usually display your lender’s name, but they may display a symbol for a selected application as a substitute. Such as, some cards are branded with benefits programs or retailer names.

Check out all investmentsStocksFundsBondsReal estate and alternative investmentsCryptocurrencyEmployee equityBrokerage accounts529 faculty savings plansInvestment account reviewsCompare on the web brokerages

This security evaluate adds an extra layer of defense and minimizes the potential risk of fraudulent routines.

An authorized user is someone that is allowed to use some other person’s credit card. The one who owns the credit account is referred to as the main cardholder.